LTC Price Prediction: Bullish Momentum Supported by Technicals and Institutional Interest

#LTC

- Technical Strength: LTC trading above key moving averages with positive MACD momentum indicates bullish technical structure

- Institutional Support: Whale accumulation and ETF interest from major firms like Grayscale provide strong fundamental backing

- Regulatory Tailwinds: SEC evaluation of multiple cryptocurrency ETFs suggests growing mainstream acceptance and potential for increased adoption

LTC Price Prediction

LTC Technical Analysis

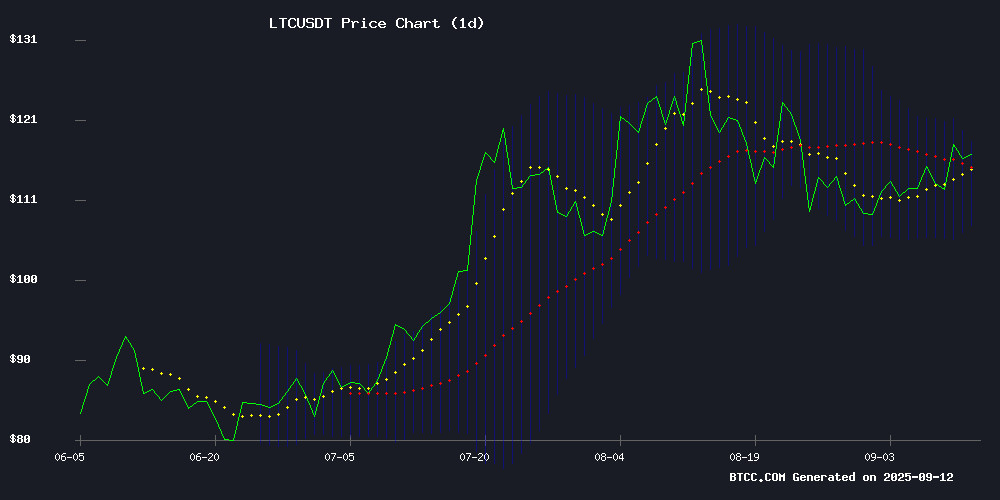

LTC is currently trading at $116.11, above its 20-day moving average of $112.71, indicating bullish momentum. The MACD shows a positive reading of 0.88, though the signal line at 3.19 suggests potential consolidation. Price is approaching the upper Bollinger Band at $118.04, which may act as resistance. According to BTCC financial analyst Mia, 'LTC's position above key moving averages and strong technical structure supports continued upward potential, though traders should monitor the $118 resistance level.'

Market Sentiment Analysis

Recent news highlights significant institutional interest in LTC, with whale accumulation and Grayscale ETF filings driving positive sentiment. The SEC's evaluation of over 90 cryptocurrency ETF applications indicates growing regulatory acceptance. BTCC financial analyst Mia notes, 'The combination of institutional accumulation and regulatory progress creates a favorable environment for LTC, though investors should remain aware of competing assets like Layer Brett gaining attention.'

Factors Influencing LTC's Price

10 Top Cryptos to Invest in 2025: Where Presales Meet Legendary Gains

The cryptocurrency market is buzzing with anticipation as investors scour the blockchain landscape for the next breakout stars. Among the contenders, BullZilla ($BZIL) stands out with its presale mechanics and meme-driven tokenomics, drawing comparisons to past successes like Dogecoin and Shiba Inu. The project embodies the high-risk, high-reward ethos that has defined crypto's most legendary rallies.

Established players such as Avalanche, Chainlink, and Polkadot continue to innovate with speed, oracle services, and interoperability. Yet the market's speculative edge remains sharp, with Bitcoin Cash, Hedera, and Litecoin offering alternative value propositions. The presale model—exemplified by BullZilla—has become a focal point for those chasing exponential returns.

This cycle's narrative blends infrastructure development with meme coin virality. Projects like Toncoin and World Liberty Financial represent the spectrum of crypto's evolution, from payment solutions to decentralized finance. The trading halls whisper one question: which token will mirror DOGE's 2021 surge or SHIB's meteoric rise?

EVEDEX Launches Farming Season with Double XP Rewards Following Beta Mainnet Rollout

EVEDEX, a next-generation non-custodial DEX built as an L3 rollup on Arbitrum Orbit, has launched its Full Beta Mainnet, attracting thousands of traders and securing a CoinGecko listing. The platform now offers seven live trading pairs, including BTC, ETH, SOL, XRP, LTC, LINK, and DOGE against USD, with limit orders processed in an average of five milliseconds.

From September 8 to October 6, EVEDEX will host a farming season, rewarding users with double experience points (XP) on every trade. This gamified approach underscores EVEDEX's dual identity as a serious trading hub and a participatory DeFi ecosystem.

HBAR Gains 5% Amid CPI Volatility as Grayscale ETF Filing Spurs Institutional Interest

Hedera's HBAR token weathered a turbulent 23-hour trading session, oscillating between $0.23 and $0.24 despite broader market volatility. The cryptocurrency found firm support at $0.23 before institutional buying pressure drove volumes to 156.1 million—four times the daily average—propelling a 5% rebound.

Technical resistance at $0.24 proved formidable, with repeated rejections underscoring this level as a critical threshold. A decisive breakout could trigger a 25% advance toward $0.25, while failure may confine HBAR to its $0.21-$0.23 range. Market technicians are watching these levels closely.

The surge coincided with Grayscale's SEC filing to convert its HBAR Trust into a spot ETF, alongside similar proposals for Litecoin and Bitcoin Cash. With a November 12 decision deadline, the regulatory milestone has already attracted traditional asset managers seeking crypto exposure. 'This marks a watershed for enterprise blockchain tokens entering mainstream finance,' noted one trader as bid volumes spiked.

HBAR and Litecoin Market Trends Amid Shifting Investor Focus

Hedera (HBAR) and Litecoin (LTC) continue to capture market attention, though trading volumes suggest waning momentum. HBAR trades at $0.2351 with a $9.9 billion market cap, despite an 11.26% drop in daily activity. Enterprise adoption bolsters its governance narrative, yet skepticism lingers about sustained growth.

Litecoin holds steady at $114.75, maintaining its reputation as a payments-focused alternative to Bitcoin. A 24.84% decline in volume signals muted interest as traders scout emerging projects like Remittix (RTX), now priced at $0.1050 during its presale phase.

SEC Evaluates Over 90 Cryptocurrency ETF Applications in Anticipation of Market Shift

The U.S. Securities and Exchange Commission is scrutinizing more than 90 cryptocurrency ETF applications, including proposals tied to Bitcoin, Ethereum, and a broad array of altcoins. Bloomberg Intelligence notes that approval could align with anticipated Federal Reserve rate cuts, potentially catalyzing a new phase of institutional adoption.

Notable altcoins under consideration span XRP, Solana, Cardano, and Polkadot, with many decisions expected by year-end. Basket-style ETFs—bundling multiple tokens into a single product—emerge as a key innovation, offering investors diversified exposure to the digital asset class.

BlackRock's conspicuous absence from the altcoin ETF race contrasts with its dominant position in traditional finance. The asset manager remains focused on Bitcoin and Ethereum products, leaving smaller rivals to carve out niches in alternative cryptocurrencies.

Layer Brett Emerges as Top Crypto Pick Over Litecoin, AVAX, and Polkadot

Experts are flagging Layer Brett ($LBRETT) as a standout investment opportunity in the crowded cryptocurrency market. The Ethereum Layer 2 memecoin combines viral appeal with robust blockchain functionality, currently priced at $0.0055 in its presale phase. Its technical architecture supports 10,000 transactions per second with negligible gas fees, while staking rewards hover near 792% APY—far outpacing established assets like Litecoin (LTC), Avalanche (AVAX), and Polkadot (DOT).

Litecoin's reputation as 'digital silver' remains intact, but its growth trajectory has plateaued. Meanwhile, Layer Brett's hybrid model of meme culture and scalable infrastructure positions it as a high-growth alternative. The project's presale momentum suggests investors are prioritizing next-generation utility over legacy networks.

Litecoin Surges on Whale Accumulation and Institutional Interest

Litecoin (LTC) has outpaced many altcoins following a notable spike in whale activity and strategic market developments. The cryptocurrency surged 5.5% to $116.89 after wallets holding over 1,000 LTC added 181,000 coins in a single day—one of the largest daily accumulations in recent months.

Two key catalysts drove the momentum. Grayscale filed new ETF applications for Litecoin, expanding its suite of regulated crypto products after similar moves for Bitcoin and Ethereum. Separately, MEI Pharma rebranded as Lite Strategy and announced a $100 million LTC treasury allocation, with its ticker changing from MEIPS to LITS—a clear nod to corporate adoption.

The whale activity coincided with 349 large transactions exceeding $1 million within 12 hours, demonstrating how institutional signals can rapidly shift market sentiment. Meanwhile, XRP network growth continued with 11,000 new wallets joining its top 10%, bringing total addresses to 6.6 million.

Is LTC a good investment?

Based on current technical indicators and market sentiment, LTC appears to be a favorable investment opportunity. The price is trading above key moving averages with strong institutional interest supporting upward momentum. However, investors should consider the following factors:

| Factor | Assessment | Impact |

|---|---|---|

| Price vs 20-day MA | $116.11 vs $112.71 | Bullish |

| MACD Signal | Positive (0.88) | Moderately Bullish |

| Bollinger Band Position | Approaching Upper Band | Potential Resistance |

| Institutional Interest | High (Whale Accumulation) | Very Bullish |

| Regulatory Environment | ETF Applications Progressing | Positive |

While technicals and fundamentals support investment, always consider risk management and portfolio diversification.